The aims of this programme will allow learners to:

- Be able to demonstrate deep knowledge and understanding of accounting and finance within wider

organisational contexts.

- Be able to understand current issues, techniques and thinking in the area.

- Be able to apply theoretical and applied perspectives and specialist skills to organisational contexts in

which they operate.

This programme consiste of 6 compulsory units:

Strategy and Global Finance (20 credits)

Strategic Financial Management (20 credits)

Strategic Auditing (20 credits)

Financial Analyst (20 credits)

Ethical behaviour and Corporate Governance (20 credits)

Corporate Reporting (20 credits)

Previous studies: to continue in the same major:

The student must have:

- University degree in a similar specialty or equivalent.

Work experience: to continue a different major

- University degree in a work-related subject, or equivalent international qualification from a learning institution recognized by BARVQ.

- If student doesn't have the academic or professional qualifications required above but have substantial managerial experience and a proven track record, we will also consider your application.

Student will need to submit:

- A Proof of identity - it could be a national identity card, your passport, or a legally valid document.

- A recent CV.

- Copies of previous certificates and qualifications / Professional experience.

- The proof of payment of €350 (the first installment of the tuition fees). This sum will be fully refunded in case of application rejection by the selection commitee.

This program will soon be available in French and Arabic. If you prefer to follow the program in one of these languages, simply indicate your preference in the application form, and we will promptly inform you once the program is ready in your chosen language.

If you choose to study in English for this program, you will need at least one of the following:

You do not need such certification if you:

- From English speaking countries, or

- Holds a high school diploma from English speaking schools, or

- Bachelor's or Master's degree from an English-speaking institution.

100% online via Online Campus (an interactive online learning environment) with intensive class discussion and collaboration.

Holders of this qualification can join a variety of UK degree programmes at an advanced stage. Degree top-up programmes can be delivered in the UK, locally, or by-distance/online.

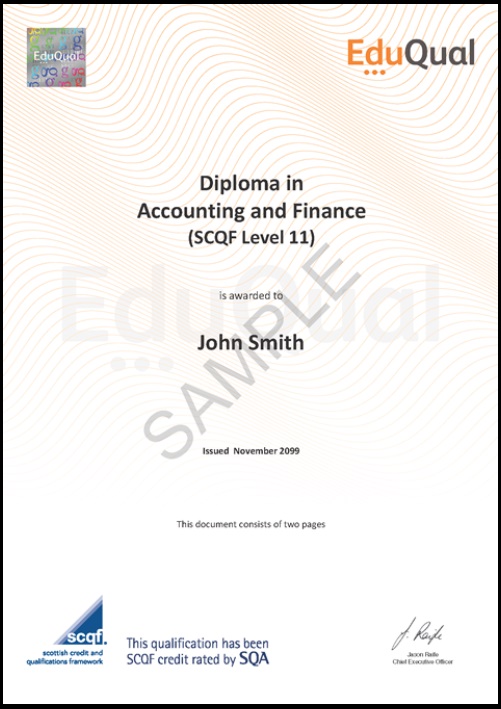

Moreover, holders of the EduQual Diploma in Accounting and Finance (SCQF level 11) can now obtain exemptions from the four components which comprise the AIA Certificate in Accountancy. This certificate is the first stage of the AIA Professional Accountancy Qualification. Details may be found at the AIA Exemptions Database.

Graduates with a Diploma in Accounting and Finance (SCQF Level 11) have a strong foundation in financial management, accounting principles, and strategic financial decision-making. Here are some potential career paths for these graduates:

- Financial Analyst: Analyzing financial data, preparing reports, and providing insights for investment decisions.

- Finance Manager: Overseeing financial operations, budgeting, and financial strategy within an organization.

- Chief Financial Officer (CFO): Taking on a senior executive role, responsible for the overall financial health of an organization.

- Forensic Accountant: Investigating financial discrepancies and fraud within organizations.

- Investment Analyst/Manager: Evaluating investment opportunities and managing investment portfolios.

- Risk Manager: Assessing and managing financial risks to optimize organizational performance.

- Internal Auditor: Reviewing and evaluating an organization's financial and information systems for accuracy and compliance.

- Management Accountant: Providing financial information to help organizations make informed business decisions.

- Financial Consultant: Offering expert financial advice to businesses and individuals.

- Treasury Analyst/Manager: Managing an organization's financial assets, liquidity, and risk.

- Financial Planner: Helping individuals and businesses create financial plans for their future.

- Credit Analyst: Assessing the creditworthiness of individuals or businesses for lending purposes.

- Business Analyst: Analyzing financial data to provide insights into business operations and strategy.

Tuition fees for Intensive program (6 months) : 3750 Euros

Tuition fees for par-time Program (9 months): 3400 Euros

Important Notice:

BARVQ is Nonprofit organization dedicated to providing unhindered access to high-quality education, fostering maximum diversity and inclusivity in learning. Despite the program's nominal cost, significantly lower than the UK standard cost, BARVQ is committed to ensuring widespread access to education.

Financial constraints should not impede your educational journey. We encourage you to apply for a scholarship, covering 25% or 50% of the total program cost, depending on your country of residence and individual financial circumstances. Your progress matters, and we are here to support your pursuit of knowledge.

In addition, we offer flexible payment options to further accommodate your needs. Upon application, a payment of 350 euros is required, fully refundable in the event of application rejection by the selection committee. The remaining balance can be paid in one or several installments during the duration of the program. For more information about payment plans and options, please contact our admission department at: [email protected]

You can apply for a scholarship by clicking here.